|

|

|

|

You are viewing: Main Page

|

|

September 15th, 2014 at 09:38 pm

Unless it's the threat of moving 15-25 miles away, as that is where the desk job will be. So much for years of a working office, and boasting $50/month car fuel. The threat of moving 1300 miles east, should he stay in his current position, did begloom my outlook. His last day with his current group is Friday. We know not what his new salary will be. I really hope it'll be a thousand dollars more per annum at least, to cope with the extra fuel and transportation costs. (Should I look into car-sharing?)

And my appeal to move my child to a course level where he will not be repeating 90% of last year's material was successful. I'll be buying him some workbooks so he can simultaneously review and catch-up for his new course level, the one last year's teacher said he was ready for.

I'm going to try for three wins a day.

Posted in

Howchadoo

|

1 Comments »

September 15th, 2014 at 06:50 pm

Getting a jump on the Jews this year in financial atonement. (Yom Kippur is October 3-4 in 2014.)

I am cleaning my portfolio. I've lost a lot because I didn't manage trailing stops nor pay attention. Made two trailing stops for dog stocks, looked at Coach ( Text is COH and Link is http://finviz.com/quote.ashx?t=COH&ty=c&ta=0&p=w COH) and Hewlett-Packard ( Text is HPQ and Link is http://finviz.com/quote.ashx?t=HPQ&ty=c&ta=0&p=w HPQ). I've read that COH and HPQ are in turnaround, but COH is maybe a quarter above its top target price. HPQ on the other hand is going up and has better fundamentals and less negative sentiment (looking at short ratios, price to free cash flow ratio, price to sales ratio). Cleaning out the portfolio is like using a dustpan and brush for scraping away dead flies and spider webs, or severing a relationship once promising and now lingering with the patina of hope.

This morning, typing out recipes from the Text is Daniel Plan Cookbook and Link is http://www.powells.com/biblio/1-9780310344261-0 Daniel Plan Cookbook. It has beautifully photographed meals: all these red, green, fresh and crunchy ingredients on white dishes. After a break, typing out recipes from Text is Wheat Belly and Link is http://www.powells.com/biblio/17-9781609611545-22 Wheat Belly. I am afraid to use a scale, much in the same way I am afraid to look at a portfolio, or glance at any measurement or yardstick that may tell me I'm doing something wrong or that I am not good enough. Besides, if my muffintop is so large I can't fit into my current clothing size I know I'm doing something wrong, and if I can fit into a certain pair of khaki shorts without triangulating my body on the bed (knees to shoulders the hypotenuse) to zip up I am doing something right. If I can stand up from a seat without feeling my weight sink into my knees I am doing something right. And I will feel I have done something right when my thighs no longer touch. What I've done right so far: taken digestive enzymes before eating pasta or whey; reduced my meat intake by at least a third, replacing it with vegetables; reducing my intake of salty, lovely Lay's Potato Chips and replacing them with handcut sweet potatoes, personally seasoned, not using the homemade mayo-sour cream dip (so tasty though!).

Awhile ago I took out a terrific, hot book from the library, Lost for Words by Edward St. Aubyn if you want to know. I misplaced it while on a family jaunt downtown. I asked about at two places I believe I may have left it at. I feel wretched. I have to suck up the book's replacement cost. I'd like to get to the point where I don't feel like a maggoty piece of feces when I make a mistake. I know I'm not atoning properly: do the Jews feel purified, renewed, invigorated after a good atonement? What are the internal signs of a successful atonement?

I muffed GnuCash. I gotta RTFM.

On the plus side, I have cleared the credit card balance, and am 73 dollars closer to paying off my home equity line of credit.

Posted in

Investing,

Salmagundi

|

0 Comments »

September 8th, 2014 at 06:31 pm

Boldly deposited funds into Roth and personal trading accounts. Boldly bought (BRK.B, PCLN, PRF, ONNN) and sold (DBA). Postponed two to three buys (SDRL, SLB, OII, WMC) because I am not confident I understand the companies' outlooks, risks, and economic moats.

We went on a clothes shopping binge, the three of us. New hiking boots, pants, and coat for the boy, new pajamas and shirts for the man, and new pants and shirts for me. When I opened one new-to-us coat's pocket prior to laundry, I found a Swiss Army knife. Yay!

More on drinking sensibly: this weekend we made an excursion to a specialty soft drink/hot dog & ice cream retail parlor, lucking into a free tasting session. We bought one sensible pop drink each, and vowed to come back for more. I have been the most sensible of our family, with no Zevia, no cheap six-pack of beer, not even Izze or San Pellegrino on sale, just a Vernor's Ginger Ale. (Moxie I save for the special moments in my life.) They have do-it-yourself pop brew kits (ginger ale, root beer of course) and 12-packs of specialty pop.

Experimenting with GnuCash, the accounting double-entry system for Linux. It has a 168-page user manual, a Wiki, mailing list and some built-in help. I wish I'd looked at the help material prior to establishing accounts. I may restart.

I lucked into $6.70/lb fresh king salmon yesterday at the supermarket. I took about $20 worth of salmon home.

I did plan meals for the week. I'd taken out Keepers and Brassicas last month. My goal is to have either 1 cup of beans or 1 cup of seeds daily, and one serving of brassicas (cabbage, kale, collard greens, mustard greens, cauliflower, broccoli, gai lan, mizuna, tatsoi, bok choy, rapini, broccoli rabe, kohlrabi, watercress, brussels sprouts) daily. So here are my week's dinner entrees:

Monday - Kale Carbonara

Tuesday - Salmon in Foil with Spinach and Cream, or Salmon with Cucumber

Wednesday - Kale and Sweet Potato Saute

Thursday - Salmon in Cream with Bay Thyme and Dill

Friday - Pasta with Red Sauce

Saturday - Mussels the Belgian Way

I must improve my planning. Our home assessment notice arrived: 10% leap from last year, so at least 10% leap in real estate tax. Sigh. Also, class year photos for child, activity fees, if you have or have had school-age children, you understand. I put some money on his prepaid bus travel card for the wet days he doesn't feel like scaling the hill to our house.

Posted in

Food / Groceries,

Investing

|

2 Comments »

August 31st, 2014 at 05:12 pm

"Dear Moxie, Welcome to Brokesville. Population: You."

I have a spreadsheet upon which I have tracked monthly balances since 2012. I should really be tracking year-to-year, instead of month-to-month, if I want some meaningful analysis. This month's special expenditures: annual license tabs, insurance for vehicle, oil change for vehicle, IKEA*, back to school supplies, running shoes, child's passport.

My cash reserves are $1000 down from last month.

The spending is not over yet. We donated old clothes that no longer fit us. I will have to buy some new clothes, but probably new-to-us from consignment, unless they are boys' clothes or sleepwear or shoes.

I did very well on food budgeting. Shifting to a 25% meat, 75% plant food plan, with more nuts and seeds for protein, has been good for my energy levels as well. I was bad and had four pops this month, one of them a beguiling Wink Martindale's Orange Passionfruit Guava concoction. On the other hand, I was good and found two local, independent places where my family could eat tasty dinners for under $10/plate.

My anxieties are concentrated around the anticipated expenditures for a child who has waded into the puberty pool. Three-inch vertical growth year-to-year, check; foot size that of mom's, check; passing out in the middle of the day, check; zits, check! Puberty, I relearn, is a time of uneven physical development. The child has a waist circumference probably six inches smaller than his inseam. Food and clothing expenditures will increase. I might have to alter some long pants. I wonder if there's a budget Sudanese or Swedish men's clothing outlet I could order from. Another complexity is our school district's dwindling transportation budget: no bus service unless the student's residence is two miles away from the school. Last year he qualified for bus service without a change in residence or school location. Our proximity to the school is just over one mile, or twenty blocks. Not a problem for an active middle-schooler. 302 ft elevation to 79 ft elevation morning walk: 79 ft to 302 ft elevation climb in the afternoon, about 37 degree grade incline for 2500 ft. His lung capacity will be outstanding.

If someone has experience with a free personal finance management package for Linux, please tell me about it.

*IKEA is furniture pr0n for me. The place where I take my vehicle for oil changes had the 2015 Catalog until the office manager offered to me. How could I refuse? My house-swap adventure of three weeks ago showed me how other people use IKEA to organize their kitchens and bathrooms and my kitchen and bathroom sure could use organizing... I spent only $125 THIS VISIT. We go once a year at the most, because parking is a hassle. My stupid purchase was a solar-powered lamp that gives 3 hours of light after its solar panels absorb 12 hours of sunlight. It's stupid because I live in the northern hemisphere, closer to the Arctic Circle than the Tropic of Cancer. It was portable, pretty, red, half-price, under ten dollars and I didn't know it was solar-powered.

Posted in

Budgeting

|

4 Comments »

August 27th, 2014 at 03:40 pm

Thank you for your sweet welcome. I look forward to gleaning and sharing with you!

I'm here at Saving Advice because most of my savings, investment, and debt repayment strategies and practices are moribund, weak, tepid and minimal. I'm not in a position where I can ply extreme strategies (live in the woods! trap your food! bicycle everywhere in a flat landscape! turn the heat off in January!). It's hard for me to pay attention to so many accounts. I don't always save more than I spend every month.

These are my challenges.

I would like to accelerate my debt pay-off and increase my taxable stock account balances, but right now it seems to me I can do one but not both.

My mortgage and car loans are both accelerated; that is, they will be paid off before the original amortization term. My home equity line of credit will be paid off after the first mortgage if I don't accelerate it. I'd like to pay the HELOC off before the first mortgage is finished, otherwise I'll have such an anticlimax. Not so much a mortgage-burning happy dance, but a shoegaze shuffle to Slint or Stars of the Lid.

Right now, I keep about twelve mortgage payments' worth of cash. This cache covers my car insurance, license tabs, utility bills, living expenses and debt payments. I have a spreadsheet for tracking the balances for these categories. When my cash exceeds 12 mortgage payments, I divide the difference into investment cash and debt repayment. The problem is the difference is usually less than $20, so the investment cash doesn't go far. The instant gratification goes to seeing some 3% or 2.79% loan decrease.

On payday $910 goes into the checking account, the rest into the money market account. Any cash left over from the last spending period goes to the credit card, which usually has a balance under $300, but is paid in full habitually.

There'll come a day when the sum balance of my home equity line of credit and my car loan will be less than my cash-on-hand: will it be worth it to pay off one loan, even if it means not having twelve months' mortgage available? Should that loan to pay off be the one that's a depreciating asset, or the one with the highest interest rate? The loan with the highest monthly payment, or the loan with the most cumulative interest?

I keep thinking there's a black belt or red belt way of making the most of a slender surplus. That's why I joined the Saving Advice community: to see how people with slender surpluses manage their amounts. I am doing things right, but not wonderfully.

Posted in

Budgeting,

Debt,

Howchadoo

|

4 Comments »

August 25th, 2014 at 11:34 pm

Hello! Hajimemashita! Douzo yoroshiku!

I was going to sell some Gilead Sciencs (NASD: GILD) earlier this week, get some Market Vectors Biotech, and the furshlugginer stock spikes: apparently the FDA granted the company's Hepatitis C pharmaceutical treatment "priority consideration." I've owned it for two years. I've got to review my holdings: I don't do it because I'm a timid, myopic kitten. Even though I drink sensibly!

Anywhoo! I have more to share, after I drink sensibly.

Stuff you'd never think to ask:

I like WFMU radio station.

I pile books on top of my bed at night, then as I drowse I push them off so they thud onto the floor.

I can frighten people without raising my voice.

I don't get along with angry, bitter alcoholics.

I like to make homemade fizzy lifting drinks: vanilla cream, strawberry shrub, golden cola, Pittsburgh fizzes. Moxie is not always available to me.

I have more consumer debt than taxable liquid assets.

I geek out about numbers. When a six-digit debt drops to a five-digit debt, or a five-digit debt drops to a four-digit one, that's numberwang.

My mortgage dropped from six digits to the left of the decimal, to five digits left of the decimal.

In one week my car loan will drop from five digits to four digits.

If the past 114 years were bus stops, I'd ask the Toonerville Trolley to let me out at 1924. I might not reboard the trolley.

I have cheap thrills and like to write about them.

Writing is cheap therapy for me, and a source of amusement.

My ring fingers are longer than my index fingers.

You wouldn't want to be riding inside my brain at night, not without a windshield.

I read a lot. I'm trying to read compulsively so I can stay off the net.

I am learning Linux. So much of it is DIY.

Lemon drinks, the Kinks, sable minks, and vivid pinks -- these are a few of my favourite things.

Drink sensibly, to toast the good times when we have them.

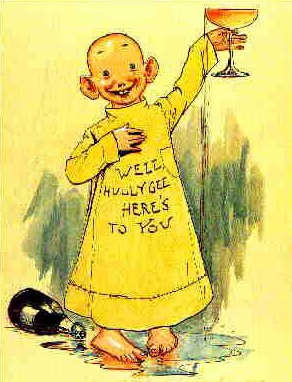

This child is not drinking sensibly. This is why his hair left him and his eyebrows are trying to do likewise. Yet I join him in pitching the "Here's To You" toast.

Posted in

Howchadoo

|

4 Comments »

|